NFT Market CAGR to be at 30.41% By 2035 | Reimagining Digital Ownership Through NFT Innovation

May 20, 2025

iCrowdMarketing powered by iCrowdNewswire

NFT Market Analysis

The Non-Fungible Token (NFT) market has transformed the digital economy, unlocking new opportunities in art, gaming, fashion, and real estate. As of 2025, the NFT landscape continues to mature with increased institutional adoption, the evolution of utility NFTs, and tighter regulatory frameworks. NFTs, digital assets stored on blockchain technology, have created unique avenues for ownership and monetization of content. Initially sparked by collectibles and digital art, the NFT market has expanded into diverse sectors, including music, sports, intellectual property, and decentralized finance (DeFi). With global NFT sales crossing billions annually, this digital innovation continues to attract creators, investors, brands, and collectors across the globe.

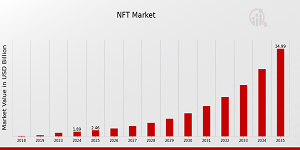

NFT Market is estimated to reach a valuation of USD 35.0 billion by the year 2035, at a CAGR of 30.41% during the forecast period 2025-2035. Digital art still remains a primary use case, but the dominance is gradually shifting toward utility-driven NFTs in gaming, virtual real estate, and brand engagement. The integration of NFTs with metaverse platforms, AI, and digital identity is further pushing the boundaries of what these tokens can represent.

Market Key Players

Several key players dominate the NFT ecosystem, offering marketplaces, infrastructure, and innovative content. OpenSea remains the largest NFT marketplace, providing a wide range of assets including art, domain names, and music. Rarible and Foundation focus more on creative and curated content, catering primarily to artists and collectors. Magic Eden and Solanart lead the Solana-based NFT space, offering fast, low-fee transactions. Blur, a newer entrant, has gained attention by targeting professional NFT traders with zero-fee models and incentives. On the infrastructure side, Ethereum continues to be the dominant blockchain for NFTs, although alternatives like Polygon, Flow, and Binance Smart Chain (BSC) are gaining popularity due to lower transaction costs and faster speeds. Notable corporate players include Yuga Labs (creators of Bored Ape Yacht Club), Dapper Labs (behind NBA Top Shot), and Immutable (a Layer-2 scaling solution for gaming NFTs). Major brands like Nike, Adidas, Starbucks, and Gucci have entered the space through NFT drops and digital twin strategies, signaling mainstream adoption.

Download Exclusive Sample Copy Of This Report Here:

https://www.marketresearchfuture.com/sample_request/11522

Market Segmentation

The NFT market can be segmented by type, application, and end-user. By type, NFTs are categorized into art, collectibles, music, video, virtual real estate, gaming assets, and utility tokens. Art NFTs often include generative art, photography, and digital illustrations, while collectibles encompass items like trading cards and profile pictures (PFPs). Music and video NFTs allow creators to tokenize ownership or licensing rights. Gaming NFTs include characters, weapons, and skins usable within blockchain-based games. Utility NFTs are an emerging class that grants holders access to experiences, discounts, or services. By application, NFTs are used in sectors such as entertainment, gaming, sports, finance, and academia. The end-user segment includes individual collectors, institutional investors, artists, gamers, and corporations seeking branding or customer engagement solutions. These segmentation dynamics underscore the evolving nature of the NFT market, allowing tailored strategies for each segment.

Market Drivers

Multiple factors are fueling the growth of the NFT market. First, increased digitalization and the creator economy have expanded demand for tools that enable digital ownership and monetization. NFTs offer a decentralized and transparent method for verifying authenticity and provenance, solving long-standing issues in digital media. The surge in blockchain adoption, alongside the rise of DeFi and Web3 platforms, supports the infrastructure needed for NFT transactions. Technological advancements in AR/VR and the metaverse also drive NFT adoption by enabling immersive experiences. Furthermore, celebrity endorsements and influencer participation have brought NFTs into mainstream consciousness. Institutional investment is also a powerful catalyst, as hedge funds, venture capital, and major corporations explore NFT-based assets for diversification. The emergence of Layer-2 solutions and alternative blockchains also addresses scalability issues, making NFT transactions more efficient and affordable.

Buy this Premium Research Report | Immediate Delivery Available at -

Market Opportunities

As the NFT market evolves, several promising opportunities are emerging. One significant area is real-world asset tokenization, where NFTs represent ownership of physical items like property, luxury goods, and even intellectual property rights. Tokenized real estate is a rapidly growing segment, allowing fractional ownership and global investment. The education sector is exploring NFT-based certifications and diplomas, offering a secure and verifiable method of credentialing. Additionally, NFTs are playing a pivotal role in digital identity, offering decentralized identifiers for individuals across metaverse platforms. Another growing opportunity is in fan engagement: musicians, athletes, and celebrities are leveraging NFTs to connect with audiences through exclusive content, merchandise, and meet-and-greets. Brands are increasingly using NFTs for loyalty programs, integrating them into e-commerce to enhance customer retention. Finally, the convergence of AI and NFTs allows dynamic NFTs that evolve over time based on user interaction or external data—an area ripe for innovation and value creation.

Regional Analysis

The NFT market exhibits different levels of maturity across regions. North America, particularly the United States, leads in terms of market share, innovation, and venture capital investment. Silicon Valley, New York, and Miami have become NFT hubs with high-profile events and conferences. Europe follows closely, with vibrant NFT activity in the UK, France, and Germany. The EU is also working on regulations under the Markets in Crypto-Assets (MiCA) framework, which may provide a more secure environment for NFT expansion. Asia-Pacific is experiencing rapid growth, especially in countries like South Korea, Japan, Singapore, and China. South Korea's gaming and tech companies are heavily investing in blockchain gaming and NFT integration. Japan's manga and anime industry has adopted NFTs as a new revenue stream. Despite China's restrictions on cryptocurrencies, state-supported blockchain platforms like BSN are exploring compliant digital asset solutions, including NFTs. The Middle East, especially the UAE and Saudi Arabia, is investing heavily in digital transformation and Web3 projects, positioning itself as a future NFT and metaverse hub. Latin America and Africa are emerging markets, where NFTs are being adopted for cultural preservation, local art exposure, and economic empowerment.

Browse In-depth Market Research Report:

https://www.marketresearchfuture.com/reports/nft-market-11522

Industry Updates

The NFT industry continues to experience rapid developments that reshape its landscape. One of the most impactful updates in 2024 was Ethereum's shift to a more scalable Layer-2 ecosystem, enabling faster and cheaper NFT minting and trading. Platforms like Arbitrum, Optimism, and zkSync are now hosting NFT projects, reducing the strain on Ethereum mainnet. The Ethereum Improvement Proposal (EIP-4884), which enhances proto-danksharding, has further improved efficiency. Another key trend is the emergence of NFT financialization—offering NFT-backed loans, fractional ownership, and derivatives through DeFi protocols. The success of Blur’s NFT lending marketplace and protocols like JPEG’d and Arcade have introduced new liquidity to space.

Meanwhile, Yuga Labs has expanded its metaverse ambitions through Otherside, with partnerships bringing in legacy brands and celebrities. Regulation is also evolving, with the SEC in the U.S. investigating NFT offerings under securities laws, prompting platforms to adopt Know Your Customer (KYC) and Anti-Money Laundering (AML) practices. On the enterprise side, Salesforce, Shopify, and Mastercard have rolled out NFT-related services, empowering businesses to integrate blockchain into marketing and sales strategies. Finally, dynamic and soulbound NFTs (SBTs) are gaining attention for non-transferable digital credentials, potentially revolutionizing digital identity and reputation systems in Web3.

Top Trending Reports:

- Multimodal AI Market

- Modelops Market

- AI Server Market

- Edge Server Market

- Legal Tech Market

- Online Language Learning Market

- CMMS Market

- Winery Management Software Market

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Also, we are launching “Wantstats” the premier statistics portal for market data in comprehensive charts and stats format, providing forecasts, regional and segment analysis. Stay informed and make data-driven decisions with Wantstats.

URL : https://www.marketresearchfuture.com/reports/nft-market-11522

Contact Information:

Market Research Future (Part of Wantstats Research and Media Private Limited)99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: sales@marketresearchfuture.com

Website: https://www.marketresearchfuture.com

Tags: English, NFT Market,NFT Market Size,NFT Market Share,NFT Market Trends,NFT Market Growth