Compound Interest and Its Power

Oct 27, 2022

iCrowdMarketing powered by iCrowdNewswire

You may already know what interest is if you have a personal loan or a credit card. This is the fee a borrower pays for using the lender’s money. If you have a savings account, you also deal with interest.

In this case, it’s a small amount of money the bank pays you for holding your funds. Sometimes the interest is supercharged when it becomes more than a small part of the original balance. Then it’s called compound interest.

The Basics of Compound Interest

When a person is willing to save money, compound interest is good as it will help their balance increase. Those who are in debt should beware of compound interest as it may make your debt grow faster. You should find out how do personal loans work so that you avoid pitfalls and common mistakes such as debt accumulation.

It’s essential to understand the power of compound interest and the way it works so that you use this information to your advantage. Knowing the basics of compound interest you will be able to make smart borrowing or saving decisions.

Pay attention to the way interest is compounded to avoid an increase in your credit card or loan balance. This type of interest is similar to a snowball as it starts small but grows continuously and becomes bigger fast.

How Compound Interest Works

To understand how compound interest works, you need to begin with the concept of simple interest. Simple interest is what you receive when you deposit your funds and the bank pays you for using your money.

For instance, if you make 5% annual interest and put $200 in a deposit, you will get $10 in interest after one year. Compound interest is what comes the next year. The client will earn interest on their initial deposit and interest on the interest they just earned.

Each year you will be able to earn more interest than the previous year due to the fact that your account balance will be $210, not $200.

This is an example of the interest that becomes compound. Various banking institutions offer a faster process when your interest compounds every day and adds to your account each month. However, you should keep in mind that it works only if you save money.

Borrowing needs can’t benefit from compound interest as it will only lead you to more debt. Compounding will work against the borrower in this case as the person will have to pay interest on the funds they have taken out.

If a borrower hasn’t repaid the whole amount in full, the next month they will owe interest on the sum they took out plus the interest that has accrued.

If you have difficulty paying interest on your loan, then you can take a quick loan to repay it. Remember that you have to pay it off as a one-time payment. You can take advantage of a simple apps that let you borrow money and resolve the issue of paying interest.

Benefits of Compound Interest

Both financial institutions and consumers may benefit from compound interest. Its power is in the so-called “snowball effect”. What does it mean? This metaphor means your snowball of savings starts small but gradually grows in size as you build wealth.

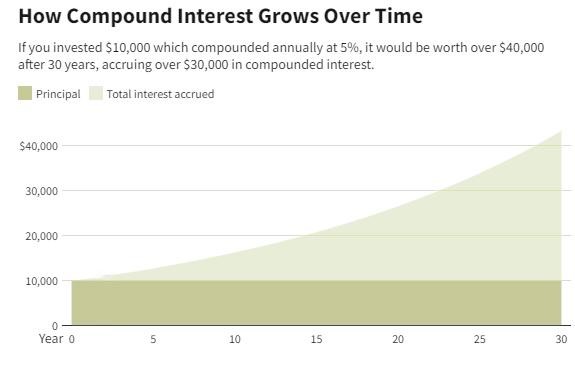

Even small investments may yield large returns with compound interest over time. Investors and people who want to maximize their savings will benefit from this snowball effect. The earlier you begin saving and investing, the more compound interest you will receive.

Drawbacks of Compound Interest

Compound interest also presents some downsides for consumers and borrowers. It is often applied to the repayment of credit card debt or student loans by lenders. Credit card issuers apply this type of interest to the debt payoff.

As a result, compound interest may grow over time and rapidly increase, especially for borrowers repaying only the minimum monthly sum on these bills. This type of interest is calculated before a person makes a payment and not after it.

Those who pay down interest according to the repayment schedule and have missed or late payments will need to pay more as their rate of return may lower.

The Truth in Lending Act (TILA) demands crediting companies to reveal lending terms to prospective borrowers, including the total sum of interest to be paid off over the life of the loan and if interest accrues simply or is compounded.

What Is The Power of Compound Interest?

When the interest is paid regularly, compounding occurs. The power of compound interest begins after a person adds interest over and over again. Here are the factors that define its power:

Fluency

If you have compounding periods more often, you will get more positive results and larger sums as their frequency matters. Once you decide to open a new account for your savings, search for those that compound daily.

Make sure the calculations are conducted every day even though the interest payments may be added to the account every month.

Interest Rate

This is another significant factor in the account balance. If you want your account to grow faster, you need to have higher rates. A bank account compounding at a lower interest rate may end up with a higher balance. Make certain you do the necessary calculations to check if that may happen.

Time

Compounding shows more benefits and results over longer periods. When funds are set aside to grow, you will get a higher number of credits or calculations to your savings account.

Deposits

Your account balance may also be affected by deposits and withdrawals. What can work best for you? It will be beneficial if you add new deposits or let your funds expand regularly. The effect of compounding will dampen if the consumer withdraws their earnings.

Starting Sum

Compounding isn’t affected by the starting sum. You may invest $100 or $100,000 and even a million, but the compound interest will work the same way.

There are no penalties if you decide to begin with a small amount or a larger sum though the larger amount will bring you larger results. Instead, concentrate on the time and rate you will get.

The Bottom Line

Whether you are looking at compound interest for your debt payments or savings, you should know what it means first. It may be beneficial for your savings and growing investments but you should be careful with debt management.

Try to repay more than the minimum monthly payment on your credit card debt or personal loan you may have. Making extra payments will help to reduce the principal and pay the debt off sooner while also saving a lot of funds in interest.

Tags: English