The Federal Minimum Wage: What Americans Think about It and Whether It Is Possible to Live on That Money?

Mar 24, 2023

iCrowdMarketing powered by iCrowdNewswire

The federal minimum wage in the USA is $7.25 today. This sum is supposed to be a living wage, but this hourly rate hasn't been updated since 2009. As there were no adjustments for inflation rates and the value of the U.S. dollar has lowered by 17%, many people claim that this minimum wage isn't a living wage anymore. Can a typical American family survive on the minimum wage, and how to save money fast on a low income if there is no other way? Keep on reading to find out.

The Definition of the Minimum Wage

What is the minimum wage? It is the lowest wage per hour that a worker can be paid. Federal law mandates this sum. Workers can disagree to work for lower rates.

Some cities and states across the country have already revised minimum wage rates and increased them to over $7.25 in 2022. Yet, low-income and minimum-wage families struggle to support their families and pay the bills. Is it really enough to get paid the minimum wage to live a comfortable life?

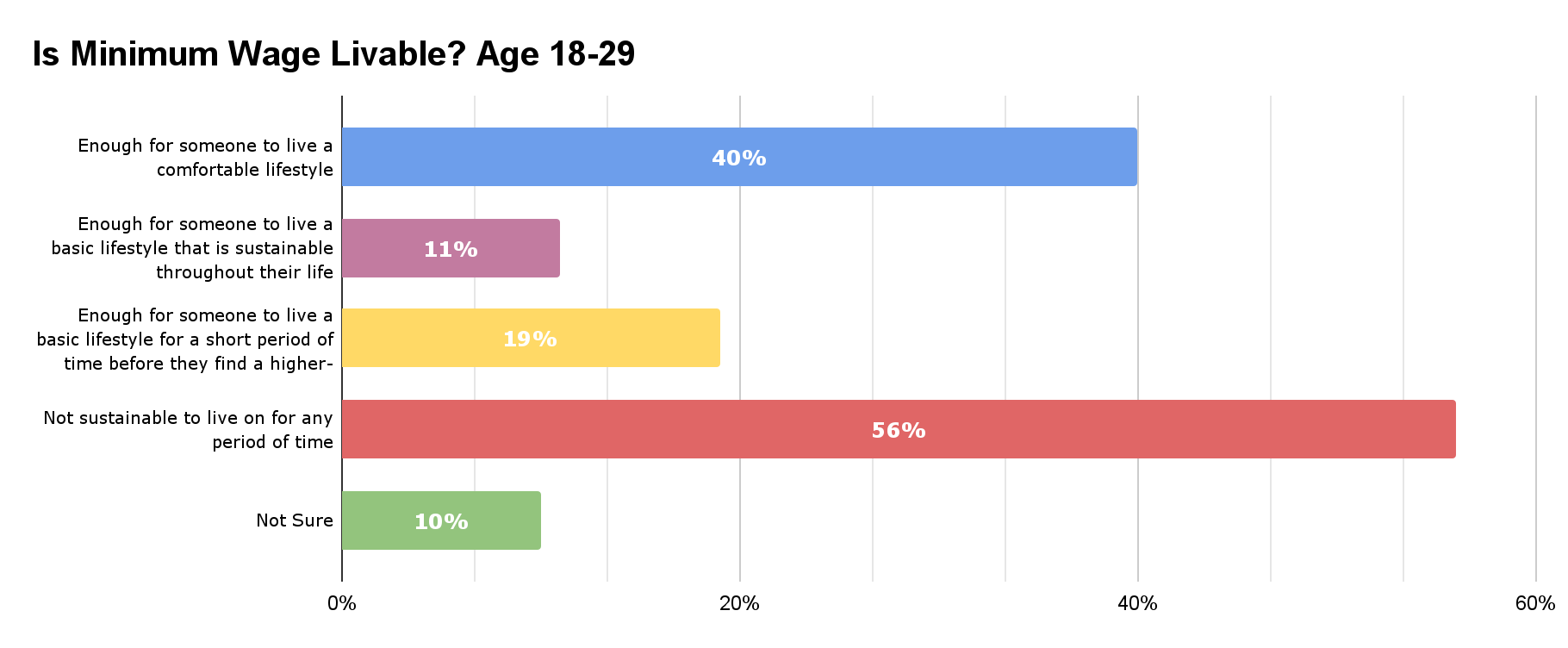

Source: https://docs.cdn.yougov.com/mdur6m7pnr/crosstabs_The%20Minimum%20Wage.pdf

According to the survey Is Minimum Wage Livable, only 4% of respondents aged 18 to 29 said having the $7.25 hourly federal minimum wage would be enough to live a comfortable lifestyle. Speaking of the gender differences, 62% of men and 76% of women said this sum isn't sustainable to live on for any period.

Federal Minimum Wage vs. State Minimum Wages

The USA enforces a federal minimum wage, but cities and states can also pass their own demands for the minimum wage, provided that the stipulated hourly wage isn't lower than the federal minimum wage.

A recruiter must pay the workers the higher wage of the two. The cost of living in different states can vary, so the minimum wage differs too. For instance, the minimum wage in Montana is $9.20, and in Massachusetts, it's $14.25 an hour.

The minimum wage rate was higher than the federal rate in 30 of the 50 states in 2022. The highest rate per hour was in the District of Columbia, where the minimum wage was $15.20 per hour. New York is the second, with a $15 minimum hourly rate.

As of January 1, 2022, just five states haven't made any updates to the state minimum wage: South Carolina, Mississippi, Alabama, Tennessee, and Louisiana. Certain states even have particular rules and exceptions concerning the minimum wage rates.

Is It Possible to Live on the Minimum Wage?

As we can see from the survey and the data above, the federal minimum wage is no longer the living wage. Though some states can review and change this hourly rate, it isn't enough to have a comfortable lifestyle and support your family's needs.

However, millions of American households have to live on this money. It is a common reason why they often rely on lending tools and often take out a payday or small personal loan. Their wages aren't enough to cover all their basic needs.

Besides, immediate costs and unforeseen expenses can easily unsettle people. About 1.1 million workers earned wages below or at the minimum wage in 2020. Recruiters can legally pay less than the federal minimum wage for full-time students or tipped employees in particular circumstances.

The Budget for The Minimum Wage Workers

If you get $7.25 an hour, you earn $290 in a typical 40-hour working week. It's easier for single people to live on this money as they don't have a family to support. If you don't take into account emergencies, illness, or vacations, you will get up to $15,080 annually. It means you won't technically live in poverty, but your budget will be rather tight.

Families with one or more kids and single parents won't be able to survive on the minimum wage. They will most likely fall below the poverty line. If we calculate the housing expenses, utilities, tax payments, groceries, transportation, and insurance, consumers living on the minimum wage won't be able to tackle debt or save.

Making regular debt payments and saving a portion of your income is important if you want to have a comfortable lifestyle, avoid financial disruptions, and manage existing debt payoffs.

After all, if you live paycheck to paycheck and often take out crediting tools, you will end up being deep into debt. The vicious debt cycle is frustrating and will prevent you from building up your savings.

What Can Be Done to Boost Your Earning Potential?

1.Government Assistance

It is extremely difficult to live on the federal minimum wage. The majority of respondents, who were interviewed about their budget on the minimum wage, claimed that they were getting some government assistance. Government aid is what helps low-income families support their needs. Both single parents and families can obtain housing aid and government help.

2. Get a Side Gig

If you get a minimum wage but want to improve your earning potential, you may get a side gig. Think about the part-time work or freelance options you can do over the weekend or in the evenings to get additional income. Extra money can be used to improve your personal finances, get rid of existing debt, or just have enough to pay monthly bills.

3.Get Help from Friends and Family

If you still don't have enough even though you get government assistance and a side hustle, you may tap your friends and relatives. Almost all workers living on the minimum wage state they are dependent on family members and friends. Some people move in with relatives or borrow some funds from their friends to cover their financial needs.

The Bottom Line

Summing up, the federal minimum wage is no longer the living wage. The state minimum wages can be different and based on the cost of living in each area.

Living on minimum wage is tough, especially if you have a family and children. Some ways to boost your earning potential include getting government aid, borrowing money from your relatives or friends, and getting a side gig.